Title fees, a component of settlement charges, significantly impact borrowers' lending strategies. Fees, varying by location, transaction complexity, and lender policies, range from 1% to 3% of the loan principal, averaging 2-3% in the US. Understanding title fees enables borrowers to:

– Budget effectively

– Save by comparing estimates from different lenders

– Negotiate better terms with strong credit profiles

Proactive cost management, including reviewing fee breakdowns and exploring reduction options, minimizes title fee impact. Lenders can facilitate this through transparent communication, flexible payment structures, targeted assistance programs, digital solutions, and educational initiatives to empower borrowers in decision-making.

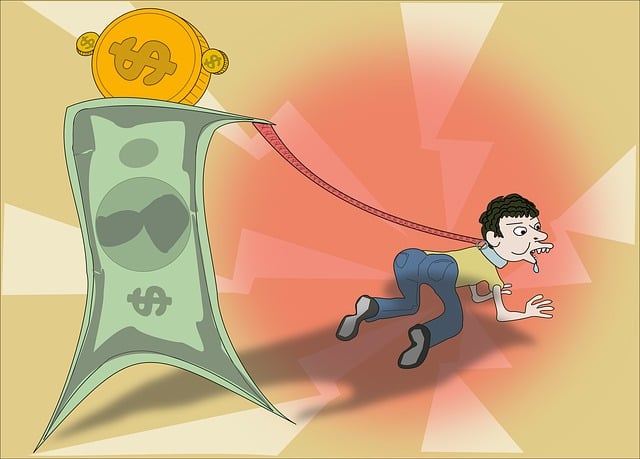

In the intricate landscape of modern lending, understanding how title fees shape borrowers’ strategies is paramount for both financial institutions and individuals seeking credit. Title fees, often overlooked, significantly influence decision-making processes by borrowers, potentially impacting their long-term financial health. This article delves into the intricate relationship between these fees and borrower behavior, providing valuable insights that can aid in navigating today’s competitive lending market. By exploring current trends and expert analysis, we offer a comprehensive guide to help readers make informed choices and optimize their borrowing strategies.

Understanding Title Fees: An Overview for Borrowers

Title fees play a significant role in shaping borrowers’ strategies, often unnoticed yet profoundly impactful. These fees, part of the broader settlement charges, represent the costs associated with transferring ownership of property during real estate transactions. They include various components such as title search fees, examination costs, and legal expenses. Understanding these fees is crucial for borrowers to make informed decisions, especially in today’s competitive lending landscape.

Borrowers must be aware that title fees can vary widely depending on factors like property location, transaction complexity, and the lender’s policies. For instance, a straightforward residential purchase might incur lower fees compared to a commercial real estate deal with multiple parties involved. Settlement charges, which encompass title fees, often amount to 1-3% of the loan principal, according to industry standards. This means that for a $500,000 mortgage, borrowers could expect to pay between $5,000 and $15,000 in settlement costs.

An in-depth analysis of title fees reveals several strategic implications for borrowers. Firstly, understanding these charges allows borrowers to budget effectively and avoid unexpected financial surprises. Secondly, comparing title fee estimates from different lenders can lead to significant savings. For example, a study by the National Association of Realtors (NAR) found that shoppping around for a mortgage could save borrowers an average of $3,000 in settlement costs. Lastly, borrowers with strong credit profiles may negotiate better terms, including lower title fees, with lenders.

To maximize savings and minimize stress during closing, borrowers should actively engage in the process. This includes reviewing all fee breakdowns, asking questions about charges they don’t understand, and exploring options for reducing settlement costs. While title fees are non-negotiable components of real estate transactions, informed borrowers equipped with knowledge and strategic planning can navigate these expenses effectively, ensuring a smoother journey towards homeownership or investment success.

Impact on Borrowing Decisions: Strategies and Preferences

Title fees play a significant role in shaping borrowers’ strategies and preferences when it comes to lending decisions. These fees, often overshadowed by interest rates, can influence how borrowers navigate the mortgage landscape. A thorough understanding of title fees and their components, including settlement charges, is crucial for both lenders and borrowers. Settlement charges, which can range from 1% to 3% of the loan amount, represent various costs associated with transferring ownership and ensuring a clear legal title.

Borrowers tend to be more strategic in their approach when title fees are transparent and competitive. For instance, a study by the Consumer Financial Protection Bureau revealed that borrowers who were well-informed about settlement charges were more likely to shop around for lenders offering lower fees. This behavior underscores the importance of clear communication from lenders regarding title fees. When borrowers perceive these fees as reasonable and predictable, they may be more inclined to accept slightly higher interest rates, thereby improving their long-term financial health.

Furthermore, borrowers with limited liquidity or those seeking larger loans might need to balance the impact of settlement charges against the potential benefits of refinancing or negotiating better terms. Lenders can facilitate this process by providing detailed fee breakdowns and offering transparent pricing structures. By doing so, they empower borrowers to make informed decisions tailored to their financial goals, especially in today’s competitive lending environment. This strategic approach ensures that borrowers receive value for their investment while lenders maintain strong relationships built on trust and transparency.

Cost Analysis: Title Fees as a Key Factor

Title fees play a pivotal role in shaping borrowers’ strategies and financial decisions, often overlooked yet significantly impacting the overall lending landscape. These fees, part of the broader title fee settlement charges, represent the costs associated with transferring ownership of property from one party to another during real estate transactions. They encompass various services, including search fees, examination charges, and legal documentation costs. Understanding these expenses is crucial for borrowers as it allows them to anticipate financial commitments, budget effectively, and make informed choices regarding their mortgages.

For instance, a study by the National Association of Realtors revealed that average title fee settlement charges range from 2% to 3% of the loan amount in the United States. This translates to substantial costs for borrowers, especially in high-value properties. A $300,000 mortgage, for example, could incur title fees totaling $6,000-$9,000, which significantly influences the overall borrowing strategy. Borrowers must consider these fees when comparing loan offers and evaluating their long-term financial plans. Additionally, transparent communication between lenders and borrowers regarding title fee structures is essential to foster trust and empower borrowers with knowledge.

Borrowers can minimize the impact of title fees by employing strategic approaches. One effective method is to shop around for competitive rates from different settlement service providers. Negotiating these fees, similar to negotiating interest rates, might yield savings. Further, borrowers should review their loan estimates thoroughly, ensuring all charges are itemized and reasonable. Proactive cost management during the lending process empowers individuals to make sound financial choices, ensuring that title fees don’t overshadow the primary objective of securing a suitable mortgage.

Credit Access and Barriers: The Role of Title Costs

Title fees play a significant role in shaping borrowers’ strategies, particularly when it comes to credit access and barriers. In today’s lending landscape, these costs, along with settlement charges, can impact an individual’s decision to pursue a loan or adjust their borrowing strategy. For instance, a study by the Federal Reserve showed that borrowers often consider title fees as a substantial upfront cost, especially in high-value transactions. This perception can either encourage borrowers to seek alternative financing options or motivate them to negotiate better terms with lenders.

When title fees are excessive, they can create a significant barrier to credit access, particularly for lower-income borrowers or those with limited financial resources. High settlement charges, which may include various fees associated with the transfer of property titles, can make borrowing more expensive and less attractive. For example, in some regions, these costs can amount to 1-3 times the loan principal, making it a substantial hurdle for borrowers seeking home mortgages or business expansion loans. As a result, lenders might need to adapt their strategies by offering more flexible payment structures or targeted assistance programs to overcome these barriers.

Lenders and financial institutions have an opportunity to foster inclusivity in credit access by transparently communicating title fee structures and exploring ways to minimize associated charges. Implementing digital solutions for title registration and settlement processes can help reduce costs, making it easier for borrowers to navigate the lending landscape. Furthermore, educational initiatives that demystify these fees can empower borrowers to make informed decisions, ensuring they understand their borrowing options and potential savings. By addressing these issues, lenders can contribute to a more equitable and accessible credit market.

Industry Insights: Trends in Title Fee Management

Title fees play a pivotal role in shaping borrowers’ strategies within the lending landscape, with industry insights revealing evolving trends in title fee management. As financial institutions navigate an increasingly competitive market, understanding and optimizing these costs have become paramount. Recent data suggests that borrowers are becoming more discerning regarding title fees and settlement charges, often comparing rates across lenders to secure favorable terms. This shift is not merely a cost-saving measure but reflects a broader trend towards transparency and efficiency in the lending process.

One notable trend is the consolidation of title services, where larger providers offer streamlined solutions, potentially reducing settlement charges for borrowers. For instance, a study by the Mortgage Bankers Association (MBA) revealed that borrowers who utilized consolidated title services experienced an average reduction of 1-2% in overall closing costs. This efficiency gain underscores the importance of strategic partnerships between lenders and title companies, enabling both parties to optimize fees while enhancing the borrower experience.

Additionally, digital transformation has introduced innovative models, such as online title search and e-recording, which significantly reduce traditional title fees by minimizing manual processes. These advancements have led to reduced settlement times and costs, making them particularly attractive to tech-savvy borrowers. As lending practices continue to evolve, lenders are encouraged to stay abreast of these trends, ensuring their fee structures remain competitive and aligned with market expectations.

Optimizing Loan Plans: Strategies to Minimize Title Expenses

Title fees play a significant role in borrowers’ strategies, often influencing their decision-making process during lending. With a keen understanding of these costs, borrowers can optimize their loan plans to minimize financial strain. This approach is particularly crucial in today’s competitive market where every dollar saved can translate into substantial benefits over the life of a loan. By carefully navigating title fees and settlement charges—which can range from 1% to 3% of the loan amount or more—borrowers can enhance their overall borrowing experience.

One effective strategy involves early engagement with reputable lenders who offer transparent fee structures. Comprehensive disclosure of all costs, including settlement charges, enables borrowers to compare options effectively. Additionally, exploring alternative funding sources or negotiating with existing creditors might yield savings. For instance, refinancing a mortgage to secure lower title fees could result in significant long-term savings. Borrowers should also consider the timing of these expenses; settling certain fees upfront or at closing may streamline the process and reduce overall costs.

Moreover, leveraging technology and digital platforms can offer cost advantages. Online lending marketplaces connect borrowers with multiple lenders, fostering competition that drives down title fees and settlement charges. These platforms often provide streamlined processes, minimizing administrative costs for both borrower and lender. As the lending industry evolves, adopting digital solutions not only enhances efficiency but also opens avenues for borrowers to access more competitive financing terms.